This year, the US federal tax deadline is April 18, 2023. If you aren’t already prepared to file, you still have some time to get started. Whether you prepare your taxes on your own or hire a professional, you might find that filing after a crowdfunding campaign is a little more complex than filing personal income taxes. In order to accurately report crowdfunded income, you may need very specific data about when you earned money and where that money came from. While we can’t offer accounting advice — and always recommend that you consult with a tax attorney, accounting adviser, or your local tax authority — there are a few issues that the crowdfunding creators we’ve worked with often run into, and that you should keep in mind while getting ready for tax season.

Crowdfunding income must be reported on your tax returns

You will need to pay tax after crowdfunding if backers receive something of value in exchange for pledging, which is generally the case when raising money through reward-based crowdfunding. Crowdfunded money received as a gift is usually not considered taxable income. When you file your taxes, you should be reporting all of the income you made through your Kickstarter, Indiegogo, or Crowdfunding by BackerKit projects for the year. There are serious consequences, including fines and prosecution, for not reporting all business income or for incorrectly reporting income. We recommend that if you’re a crowdfunding creator who has raised funds through Kickstarter, Indiegogo, or Crowdfunding by BackerKit, you speak to a tax professional to ensure that you are meeting all of your tax obligations.

How can crowdfunding creators determine how much money to report on tax returns?

The crowdfunding platform you use will send a 1099-K form to you if you raised more than $20,000 with more than 200 backers, and you have a US bank account. The form will detail the gross amount of revenue you earned from crowdfunding transactions, and assist you in reporting your income.

However, the 1099-K form doesn’t tell the full story about how much money you, as the campaign organizer, need to report. Here are a couple of reasons why:

- Even if you don’t meet the thresholds for receiving the form, you are still required to report your crowdfunding income.

- According to the Internal Revenue Service (IRS) website, the form does not “include any adjustments for credits, cash equivalents, discount amounts, fees, refunded amounts or any other amounts.”

- Project transactions that were generated outside of Kickstarter or Indiegogo won’t be reported on the 1099-K that you receive from them, but you’ll still have to pay taxes on those funds.

- Some of the money included in the form may be tax-deductible.

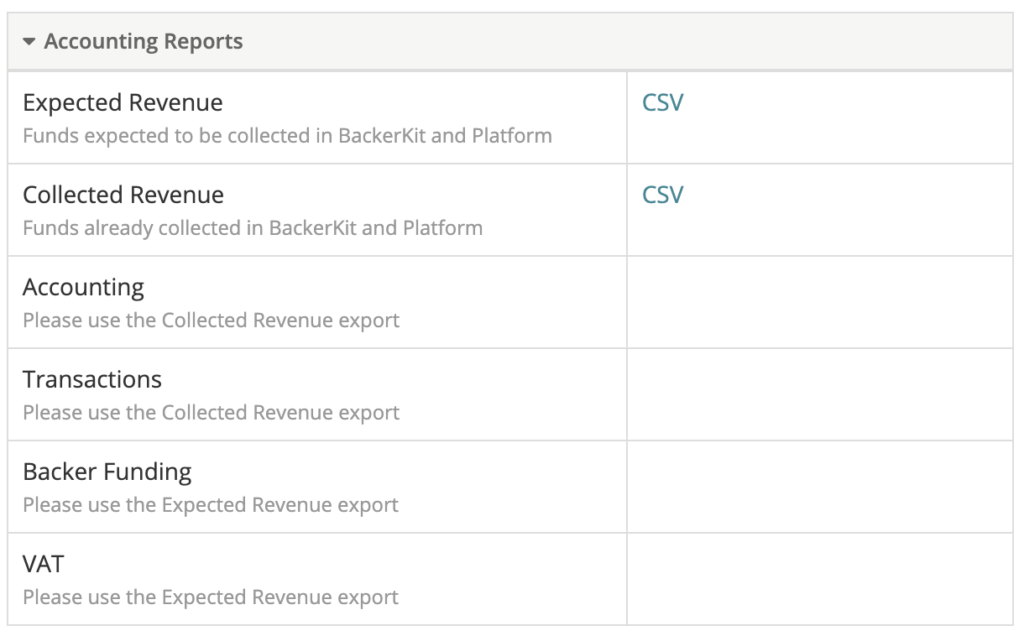

To see what your true taxable income is, it helps to get a breakdown of the money you made. If you were keeping very clear records throughout your campaign about how all of your funds were being allocated, you can use that as a guide. But if you haven’t done that, you don’t need to worry. With BackerKit Accounting Reports, you can see all of the money you raised through Kickstarter or Indiegogo campaigns as well as money raised through BackerKit.

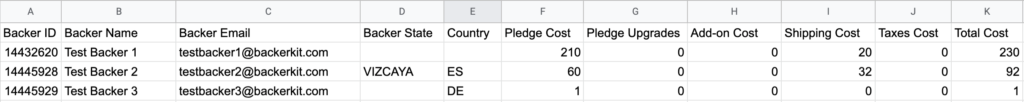

Download the Expected Revenue Report to get a detailed breakdown of where your revenue is coming from. Along with backer identification data, like email and location, this report shows you the pledge level cost, pledge level upgrades, add-on cost, shipping cost, tax cost and total cost for each backer.

This report details the expected revenue for your backers in BackerKit, meaning this is what your project is expecting to collect based on the current backer data (regardless of survey completion) in BackerKit. The report will be more accurate after you’ve successfully charged your backers in BackerKit.

This report can also be helpful throughout the year for bookkeeping purposes. For example, in some states, all shipping charges are considered taxable. In other states, shipping charges aren’t taxable. With the Expected Revenue Report, you can see which state money is coming from and how much of that money is allocated for shipping, so you can determine if funds are taxable.

Decide which accounting method you’re using

There are two accounting methods: accrual accounting and cash basis accounting. With the accrual method, you record revenue when you provide goods or services. If you’re using cash basis, however, you record revenue when you receive money, even if you haven’t delivered the goods or services yet.

When you pay taxes, you’ll need to classify income based on the accounting method you’re using. If you’re using the cash method, and you collect money from your backers during the 2020 tax year, but won’t ship out rewards until later in 2021, you’ll have to report the money on your 2020 tax returns. If you’re using the accrual method, and you collect money during the 2020 tax year, but don’t ship until the 2021 tax year, you won’t have to report that income on your 2020 tax returns. Instead, you’ll report the income the following tax year.

Crowdfunding creators often use the accrual method. It allows you to offset some of the costs associated with shipping and manufacturing that might occur several months after you’ve finished your campaign.

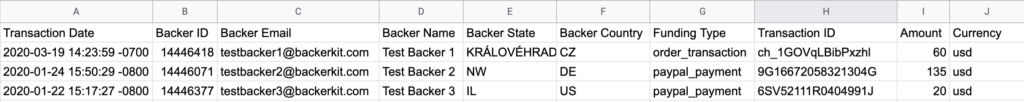

Regardless of the method that you’re using, you will want to know when transactions occurred. To do this in BackerKit, you can take a look at the Collected Revenue Report. This is an Accounting Report that shows you all of the transactions that happened in BackerKit. Also, toward the bottom of the report, Kickstarter or Indiegogo transactions will be listed in the section titled “platform_pledge.” The report displays the backer ID, backer email, backer state, backer country, transaction ID, transaction date, transaction amount, and transaction source.

Ensuring you have enough money to cover taxes

When it comes to paying taxes, no one wants to dip into funds that weren’t already earmarked for that purpose. As a creator, you may need that money to cover other aspects of your project, like manufacturing costs. You can make sure you have enough money on hand to cover your taxes by doing the following:

- Factor the taxes you’ll have to pay into your funding goal. You should consult with an accountant and look up the federal tax rates to get an idea of what you’ll owe.

- Take some time to research the benefits of the accrual method of accounting. As mentioned earlier, you may be able to write off expenses that occur after you’ve collected money from your backers. This could relieve some of your tax burden.

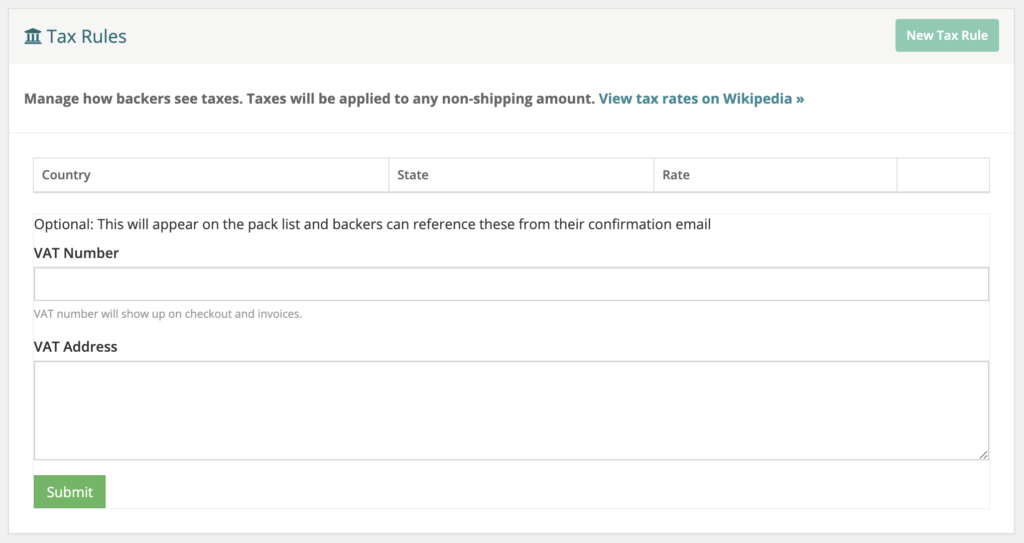

- Collect additional taxes in BackerKit. Using the Tax Rules feature, you can charge an additional percentage based on the total cost of the backer’s pledge level plus the cost of any add-ons selected in BackerKit (minus shipping).

This feature lets you set a tax rate based on country and/or state. Doing this may increase the amount a backer will owe, which will give you additional funds when paying income tax. One added bonus: If you have backers in the EU, you can also add your VAT number and VAT address in the Tax Rules section. This information will show up on your pack list and backers’ confirmation screens and emails.

What about sales tax?

Depending on where you’re located, you may need to pay sales tax. Typically, crowdfunding creators will only have to pay sales tax on transactions if they have a significant connection to the location of the backer. So if you live in California, you may have to pay sales tax on all of the transactions from backers in California.

To figure out your sales tax obligation, you will need to identify where backers are located.

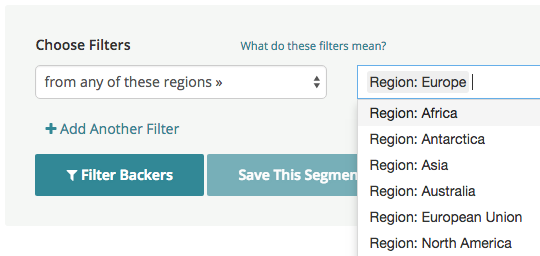

Trying to manually divide backers up by location can be challenging — especially if you have a large number of US and international backers. One way to make this process easier is with BackerKit’s Segments tool. Segments allow you to zero in on specific backer data points.

Use the tool to split up your backers into smaller groups based on criteria such as location, the items they purchased, or pledge level.

Tax season can be stressful. But when you’re prepared, you can face it with confidence. Contact our team to learn more about these BackerKit tax tools and other features that will help you stay organized and manage your crowdfunding campaigns.

Disclaimer: BackerKit does not provide tax advice. The information presented here is for informational purposes only, and does not constitute tax, legal, or accounting advice. Consult a tax attorney, accounting adviser, or your local tax authority regarding crowdfunding tax implications and obligations that pertain to your project.

Editor’s Note: This blog post was originally published in 2021. It has been updated for relevance and accuracy.